About IndianMoney.com:

IndianMoney.com is not a seller of any financial products. We only provide FREE financial advice / education to ensure that you are not mis-guided while buying any kind of financial products.

If you buy

- A house

- Debt fund (Gold Exchange traded fund, Fixed maturity plan, Debt mutual fund,Liquid fund).

- Equity (shares and mutual funds)

- Gold jewelry/ornaments/coins

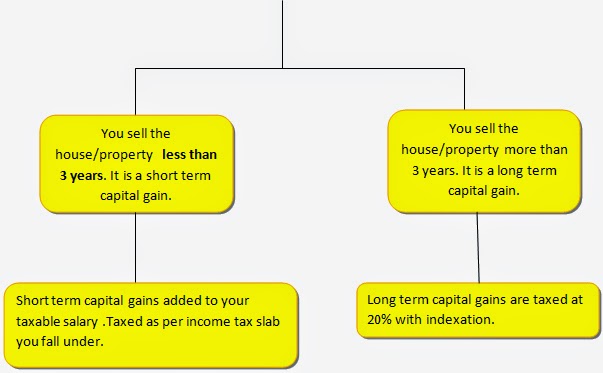

House

/Property /Apartment

Save on long term capital gains tax when you sell your house:

Section 54

You need to invest your long term capital gains in

If you have already purchased a residential house/property/apartment within a year before selling your house

Construct a residential house/property within three years of selling your house

You can set off (adjust your long term capital gains against the cost of this newly purchased/constructed house or apartment up to its cost).

You have to invest the long term capital gain in a single residential house within the country.

You can deposit your long term capital gains in a capital gains account scheme

before the due date of filing your income tax returns.

You can withdraw this money and then invest in the residential house/property within the time specified (2 or 3 years)You get interest on this amount just like a savings bank account.

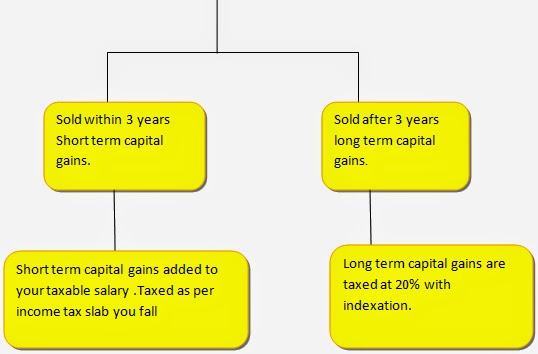

Capital gains on selling your gold jewelry:

Gold

jewelry (Physical gold)

You need to invest your long term capital gains in :

A residential house/property/apartment within 2 years of selling your house.

If you have already purchased a residential house/property/apartment within a year before selling your house Construct a residential house/property within three years of selling your house

You can set off (adjust your long term capital gains against the cost of this newly purchased/constructed house or apartment up to its cost).

You get this exemption provided you do not have more than a single house/property.

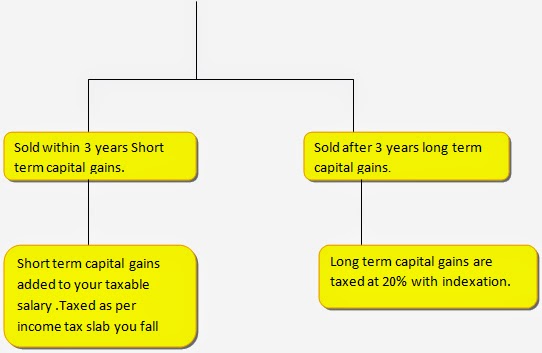

Capital gains on debt funds:

Liquid fund

Gold Exchange traded fund

Fixed maturity plan (FMP)

Monthly income plan (MIP)

Fund of funds.

Debt

Funds

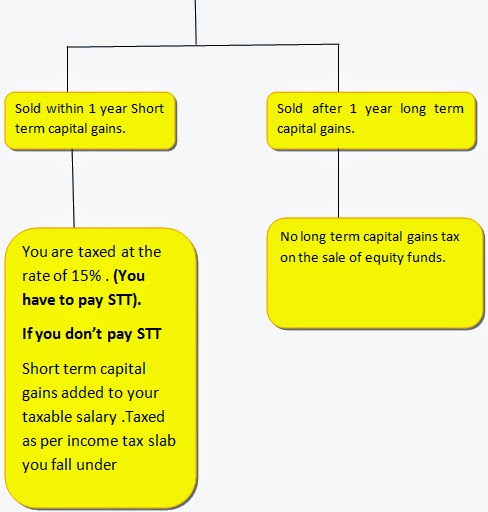

Capital gains on selling equity funds:

Shares/equity

mutual funds