About IndianMoney.com:

IndianMoney.com is not a seller of any financial products. We only provide FREE financial advice / education to ensure that you are not mis-guided while buying any kind of financial products.

If you buy

- A house

- Debt fund (Gold Exchange traded fund, Fixed maturity plan, Debt mutual fund,Liquid fund).

- Equity (shares and mutual funds)

- Gold jewelry/ornaments/coins

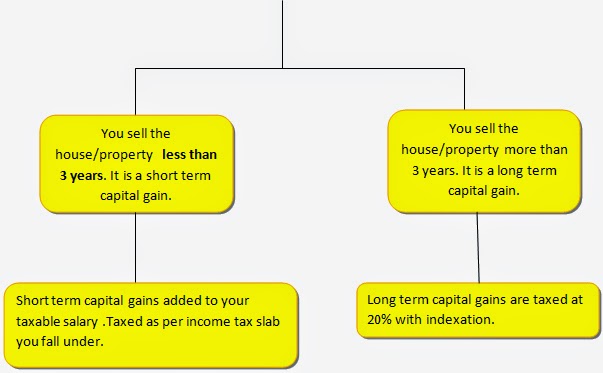

House

/Property /Apartment

Save on long term capital gains tax when you sell your house:

Section 54

You need to invest your long term capital gains in

If you have already purchased a residential house/property/apartment within a year before selling your house

Construct a residential house/property within three years of selling your house

You can set off (adjust your long term capital gains against the cost of this newly purchased/constructed house or apartment up to its cost).

You have to invest the long term capital gain in a single residential house within the country.

You can deposit your long term capital gains in a capital gains account scheme

before the due date of filing your income tax returns.

You can withdraw this money and then invest in the residential house/property within the time specified (2 or 3 years)You get interest on this amount just like a savings bank account.

Capital gains on selling your gold jewelry:

Gold

jewelry (Physical gold)

You need to invest your long term capital gains in :

A residential house/property/apartment within 2 years of selling your house.

If you have already purchased a residential house/property/apartment within a year before selling your house Construct a residential house/property within three years of selling your house

You can set off (adjust your long term capital gains against the cost of this newly purchased/constructed house or apartment up to its cost).

You get this exemption provided you do not have more than a single house/property.

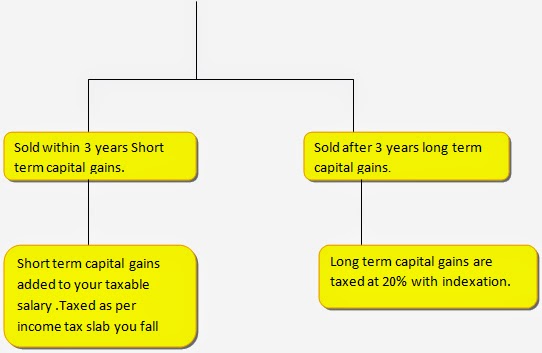

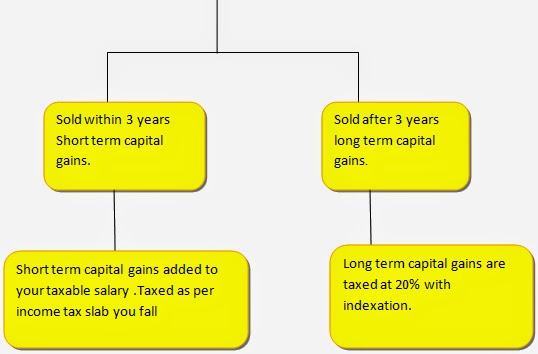

Capital gains on debt funds:

Liquid fund

Gold Exchange traded fund

Fixed maturity plan (FMP)

Monthly income plan (MIP)

Fund of funds.

Debt

Funds

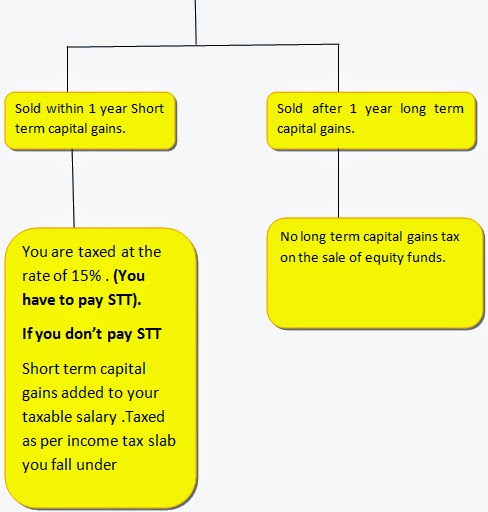

Capital gains on selling equity funds:

Shares/equity

mutual funds

I’m Артур Борис a resident/citizen of the Republic Of Russian. I’m 52 years of age, an entrepreneur/businessman. I once had difficulties in financing my project/business, if not for a good friend of mine who introduced me to Mr Benjamin Lee to get a loan worth $250,000 USD from his company. When i contacted them it took just five working days to get my loan process done and transferred to my account. Even with a bad credit history, they still offer their service to you. They also offer all kinds of loan such as business loans, home loans, personal loans, car loans. I don’t know how to thank them for what they have done for me but God will reward them according to his riches in glory. If you need an urgent financial assistance contact them today via email lfdsloans@outlook.com WhatsApp information...+1-989-394-3740

ReplyDelete